Consider the hypothetical example of John and Jane Smith. The Smiths have done well in life and typically donate $10,000 each year to the charities they love, including John’s alma mater in Illinois, their church in Florida, and several small charities Jane loves here in Door County.

On their 2017 tax return, the Smiths claimed itemized deductions of $23,000. They deducted $6,000 in mortgage interest, $7,000 in state and property taxes, and $10,000 in charitable gifts. Unfortunately in 2018, under the new tax law, the higher standard deduction of $24,000 means the Smiths will no longer be able to itemize their deductions. Hence, they are not entitled to any tax deduction for the $10,000 they contribute to charity every year.

For a couple like the Smiths, bunching several years of charitable gifts into a single year through the Door County Community Foundation is the perfect tax planning tool. They can combine multiple years of charitable donations into this tax year to exceed the standard deduction.

For a couple like the Smiths, bunching several years of charitable gifts into a single year through the Door County Community Foundation is the perfect tax planning tool. They can combine multiple years of charitable donations into this tax year to exceed the standard deduction.

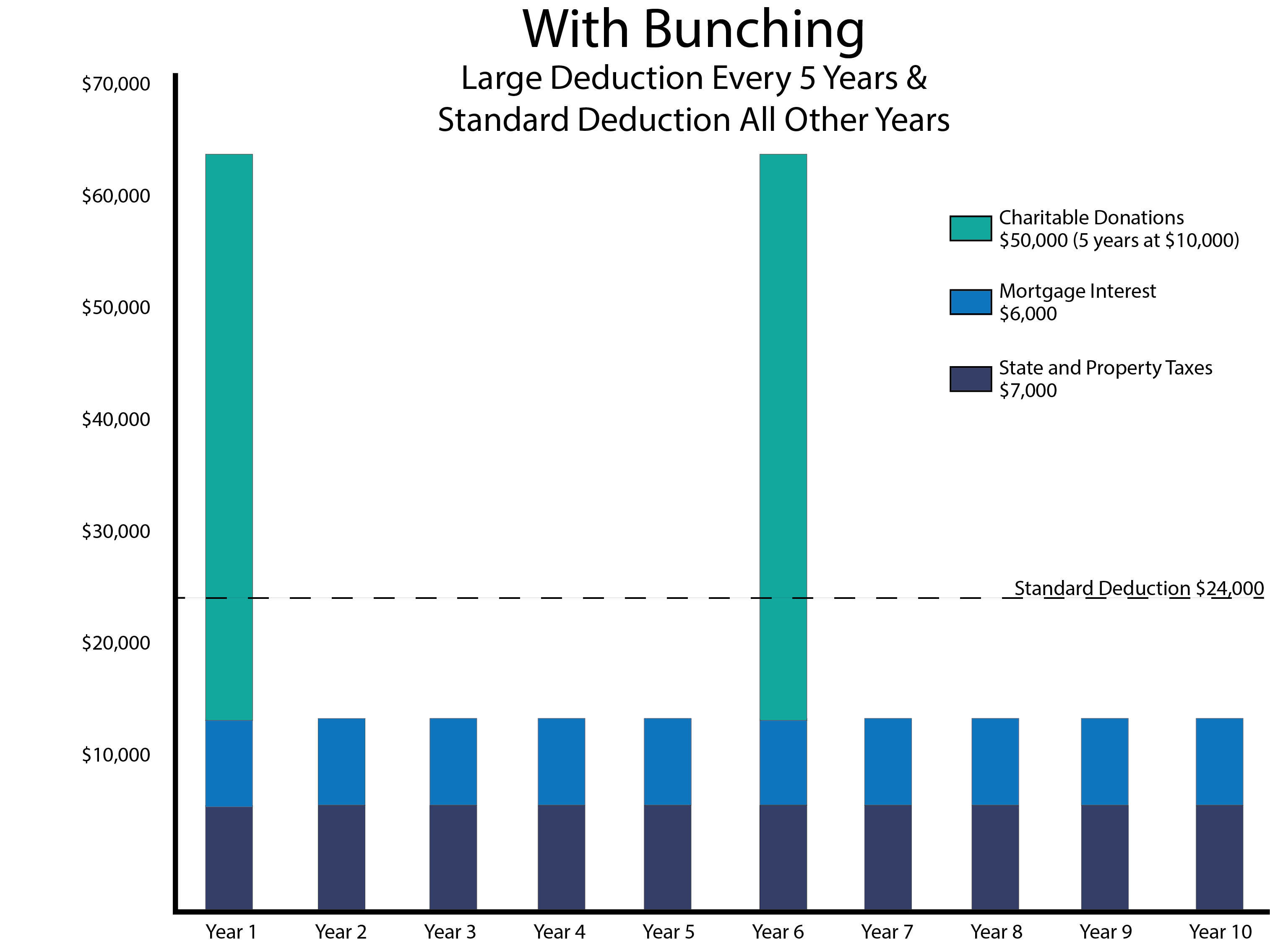

So the Smiths visit the Door County Community Foundation and create the John and Jane Smith Donor Advised Fund. After conferring with their advisors, the Smiths decide to bunch five years of future charitable gifts into this tax year and thus contribute $50,000 into their Donor Advised Fund today. As a result, the Smiths claim $63,000 in itemized deductions on their 2018 tax return. It’s the same $6,000 in mortgage interest and $7,000 in state and property taxes, but it now includes a single $50,000 gift to their Donor Advised Fund.

So the Smiths visit the Door County Community Foundation and create the John and Jane Smith Donor Advised Fund. After conferring with their advisors, the Smiths decide to bunch five years of future charitable gifts into this tax year and thus contribute $50,000 into their Donor Advised Fund today. As a result, the Smiths claim $63,000 in itemized deductions on their 2018 tax return. It’s the same $6,000 in mortgage interest and $7,000 in state and property taxes, but it now includes a single $50,000 gift to their Donor Advised Fund.

Then the Smiths use their Donor Advised Fund to pay out $10,000 in contributions every year over the next five years, including to John’s alma mater in Illinois, their church in Florida, and several small charities Jane loves here in Door County. If the Smiths prefer, the money in their Donor Advised Fund can even be invested during those five years so they’ll have even more money to give away to charity. Regardless, neither the distributions from their Donor Advised Fund, nor any earning on it, have any tax implications for the Smiths. They claimed their $63,000 in itemized deductions in 2018.

In the following four tax years of 2019 to 2022, the Smiths then claim the standard deduction on their tax return. Finally, in 2023, the Smiths might decide to do it all over again and replenish their Donor Advised Fund by bunching the next five years of contributions into 2023, thereby repeating the cycle. This simple tax strategy gives the Smiths an additional $78,000 in tax deductions over 10 years.

The savings can be magnified if their gift is made with highly appreciated stock. In that case, they’d also avoid the capital gains taxes.

A Powerful Tax Strategy

Bunching charitable gifts through a Donor Advised Fund at the Door County Community Foundation is an incredibly powerful tax planning tool for generous families.

Donor Advised Funds are convenient, flexible tools for those who want to be personally involved in suggesting grant awards made possible by their gifts. If you have a range of community interests, you may find that it’s an ideal vehicle for fulfilling your charitable wishes. Donor Advised Funds are typically less costly and easier to administer than other forms of philanthropic giving (such as family or corporate foundations).

Your gift can be combined with others to increase its impact, and you can add to the Fund you establish at any time, receiving tax benefits with each new gift. You can establish a Fund today and make grant recommendations now or in the future. And if you endow your gift, it becomes a permanent community funding resource.

Talk with your professional wealth or tax advisor to determine whether bunching charitable gifts through a Donor Advised Fund might be a good tax planning tool for your unique situation.